Check Your CIBIL Score Before Applying Your Loan*

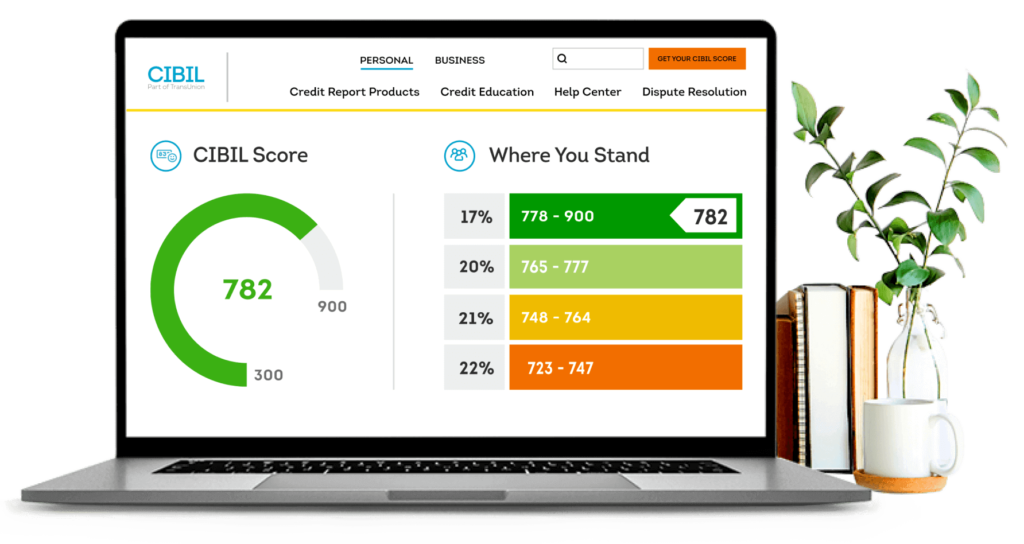

A CIBIL score is a credit score provided by TransUnion CIBIL, which is one of India’s foremost credit information companies. This score ranges from 300 to 900, with a higher score reflecting better credit health and financial reliability. The score is calculated based on your credit history, including your borrowing and repayment patterns, and serves as a crucial indicator for lenders to assess your creditworthiness when you apply for loans or credit cards.

Why Check CIBIL Score?

Know Your Creditworthiness: Checking your CIBIL score gives you a clear understanding of your creditworthiness, which reflects how reliable you are in managing and repaying debt. A higher score indicates a stronger credit profile, which is crucial for obtaining favorable loan terms.

Identify Errors in Your Credit Report: Regularly reviewing your CIBIL score helps you spot any discrepancies or errors in your credit report. Identifying and correcting these issues early can prevent potential problems with your credit profile and ensure its accuracy.

Improve Your Chances of Loan Approval: A good CIBIL score significantly enhances your chances of securing a loan. Lenders use your credit score to assess the risk of lending to you, and a higher score can lead to better loan offers and lower interest rates.

Monitor Your Credit Health Regularly: Keeping an eye on your CIBIL score allows you to track your credit health over time. Regular monitoring helps you stay informed about your credit status and manage your finances effectively to maintain a healthy credit score.

How to Check CIBIL Score

Enter Your Personal Details

Begin by providing your personal information, including your name, contact details, and identification number. This information is necessary to create your account and retrieve your credit report.

Verify Your Identity

To ensure the security of your information, you will need to verify your identity. This usually involves answering security questions or providing additional identification documents to confirm that you are the rightful owner of the credit information.

Get Your CIBIL Score and Report

Once your identity is verified, you can access your CIBIL score and report. This will include a summary of your credit history, outstanding loans, and payment patterns, allowing you to assess your creditworthiness and take necessary actions to improve your score if needed.

What Affects Your CIBIL Score?

– Payment history (30%)

– Credit utilization (25%)

– Credit age (20%)

– Credit mix (15%)

– New credit (10%

Improve Your CIBIL Score

– Pay bills on time

– Keep credit utilization low

– Monitor credit report errors

– Avoid new credit inquiries

Why Check CIBIL Score Online?

Check CIBIL score online offers a range of benefits that make managing your credit profile both convenient and efficient. The process is designed to be user-friendly, allowing you to access your score from the comfort of your home without the need for extensive paperwork or documentation. You receive instant results, enabling you to quickly assess your credit standing and make informed financial decisions. Best of all, this service is completely free of cost, providing you with valuable insights into your credit health without any financial commitment.

CIBIL Score Range:

- 750-900: Excellent credit score—Indicates strong creditworthiness and reliability.

- 700-749: Good credit score—Shows a solid credit history with minimal risk.

- 650-699: Fair credit score—Reflects a moderate credit profile with some risk.

- 600-649: Poor credit score—Indicates higher risk and may affect loan approvals.

- Below 600: Bad credit score—Suggests significant credit issues and challenges in obtaining loans

Improve Your CIBIL Score:

– Pay your bills on time

– Keep credit utilization low

– Monitor your credit report

– Avoid multiple credit inquiries

How is CIBIL Score Calculated?

– Payment history (30%)

– Credit utilization (25%)

– Credit age (20%)

– Credit mix (15%)

Contact Us

Have questions about check CIBIL score or need assistance with your credit report? Our team at Loanwalas is here to help! Reach out to us for personalized support and guidance on understanding your credit score and improving your financial health. Contact us today!

Check out our loan services Business Loan Services | Car Loan Services | Personal Loan Services | Home Loan Services